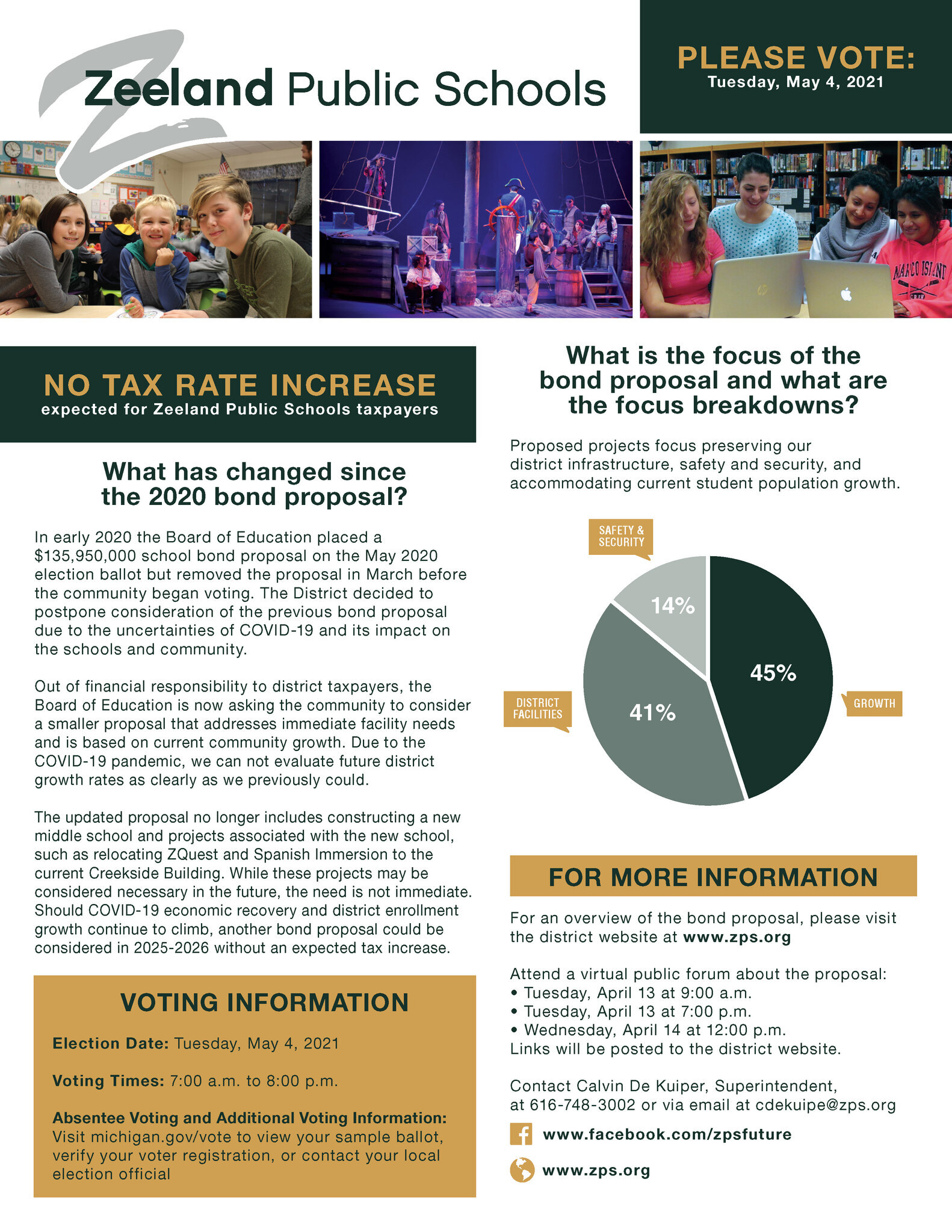

Bond Update

The 2021 bond projects are nearing completion, with the final updates wrapping up this year.

Zeeland Public Schools is grateful for the community’s continued support and excited to see students benefiting from these improved and newly constructed spaces every day.

See the Progress: Bond Project Updates - Highlights

Athletic Complex

Take a look at how the new ZPS Athletic Complex is coming together. Every beam, brick, and blade of turf brings us one step closer to a space our students and community will be proud to call home.

Roosevelt

Peter Rogovich and 5th grade teachers Ashley Pierce and Lisa Koeman share how transformative having A/C and upgraded facilities has on student learning.

Cityside

Choir teacher Taryn Gontjes takes us into her classroom to see how the new baby grand piano enhances student performance.

Adams

Teacher Travis Voss and Principal Mark Gronevelt talk about the significant renovations and addition going on at Adams Elementary.

Zeeland West High School

Mark Vizithum comes alongside students to use safer, upgraded equipment in the student woodshop.

Jeff VanHuis shows off the upgrades in the student metalshop.

Athletic Directors Josh Glerum and Jordan Bandstra highlight the physical education additions and renovations at Zeeland East and West High Schools.

Zeeland East High School

Athletic Directors Josh Glerum and Jordan Bandstra highlight the physical education additions and renovations at Zeeland East and West High Schools.

a complete list of highlights:

Zeeland Public Schools Bond Updates

Project Manager Dave Fleece Fall 2024 Updates

A comprehensive Update of all projects

School Funding Explained - Where Your Dollars Go

Ever wondered how your tax dollars directly support students at Zeeland Public Schools?

These quick, 1-minute videos explain how bonds, millages, and community investments create opportunities for students and help build a stronger future.

Take a minute to learn how it all works and why it matters for our schools. Thank you for your support!

School Finance for You - How your taxes support education - Taxpayers pay income, sales, and property taxes to support education. Anyone who buys or sells real estate or purchases a lottery ticket also supports education. Reviews how taxes support the School Aid Fund, including the 6 mill state education tax, non-homestead property 18 mill non-principal residence tax, 2% of the 6% sales tax, and 60% of the remaining 4%, the 23.88% of gross income tax collections, all revenue generated from 6% of real estate transfer tax, and net profits from the state lottery program. Millages levied by Ottawa Area ISD to benefit districts and local school district millage proposals (bond and sinking fund) are reviewed. Explains how bonds work to pay for projects, differentiating between how a millage and sinking fund work to fund school projects and impact revenue.

School Funding for You - Ever wonder how public school districts in Michigan are funded? Proposal A and the State-based model, 6-mill State education tax on properties, State School Aid Fund, and the per pupil allocation (the foundation allowance). Bond millage requests and sinking millage requests and how they are used by local school districts.

School Finance for You - How Schools Spend their Resources - How schools spend their resources. Directly supporting students is the priority of K-12 students.